Top Customer Satisfaction Survey Examples to Boost Results

Discover our best customer satisfaction survey examples. Master NPS, CSAT, and CES for actionable insights and an elevated CX strategy.

- 21 min read

Unlocking Customer Insights: Your Guide to Effective Surveys

Understanding your customers is crucial in today's competitive business world. Whether you're a new startup, a local store, or a growing company, listening to your customers is key to success. Businesses have always looked for ways to understand customer sentiment, from old-fashioned suggestion boxes to modern digital surveys. This shows how important customer feedback is for growth and building strong relationships. A truly effective approach focuses on gathering targeted, actionable insights to improve customer experience (CX) and boost your bottom line.

This guide explores the world of customer satisfaction surveys, showcasing eight different types that have proven valuable for businesses. We'll look at the principles behind each survey type, discuss how to use them, and share real-world examples. By the end, you'll have the knowledge to turn customer data into a powerful growth engine for your business.

Eight Effective Customer Survey Examples

- Customer Satisfaction (CSAT) Surveys: These measure how satisfied customers are with your products or services. They often use a simple scale (e.g., 1-5 stars) to gauge satisfaction.

- Net Promoter Score (NPS) Surveys: NPS surveys ask customers how likely they are to recommend your business to others. This helps measure customer loyalty and identify potential brand advocates.

- Customer Effort Score (CES) Surveys: CES focuses on how easy it is for customers to interact with your business. It measures the effort required to complete a task or resolve an issue.

- Post-Purchase Surveys: These surveys are sent after a customer makes a purchase. They provide valuable feedback on the buying process and product experience.

- Product Feedback Surveys: These gather specific feedback on product features, functionality, and usability. They help identify areas for improvement and innovation.

- Website Feedback Surveys: These surveys focus on the user experience on your website. They can help identify navigation issues, broken links, or other usability problems.

- Email Surveys: Email surveys are a convenient way to reach a large audience. They can be used for a variety of purposes, from satisfaction surveys to market research.

- Mobile App Feedback Surveys: These surveys target users of your mobile app. They gather feedback on the app's design, functionality, and overall user experience.

Implementing Customer Surveys Effectively

- Define Your Objectives: Before creating a survey, clearly define what you want to learn. What specific information are you trying to gather?

- Target the Right Audience: Ensure you're sending your survey to the relevant customer segment. Targeting the right audience will yield more valuable insights.

- Keep it Concise: Long surveys can be daunting for customers. Keep your surveys short and focused to maximize completion rates.

- Offer Incentives: Consider offering a small incentive (e.g., a discount or gift card) to encourage participation.

- Analyze the Results: Once you've collected data, carefully analyze the results. Look for trends, patterns, and actionable insights.

Using these tips, you can turn raw customer data into valuable business intelligence. Start gathering feedback today and unlock the potential of your customer base.

1. Net Promoter Score (NPS) Survey

The Net Promoter Score (NPS) survey is a popular way to measure customer satisfaction. Its widespread use comes from its simplicity and the valuable insights it offers into customer loyalty. The survey asks just one question: "On a scale of 0-10, how likely are you to recommend our product/service to a friend or colleague?"

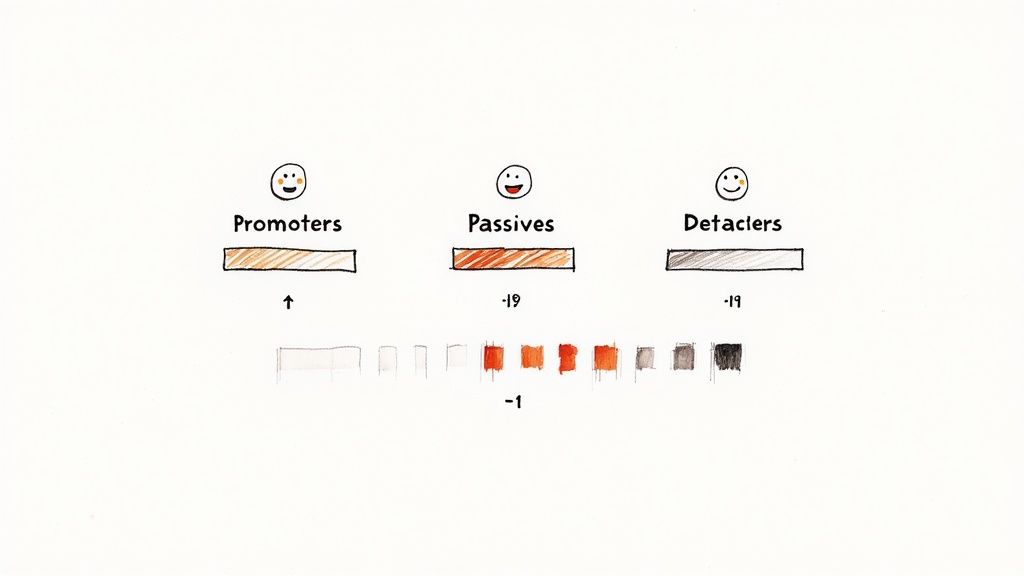

Based on their answers, customers fall into three groups:

- Promoters (9-10): These loyal customers love your brand and are likely to recommend it.

- Passives (7-8): These customers are satisfied but not fully committed and might switch to a competitor.

- Detractors (0-6): These unhappy customers may share negative reviews and hurt your brand's image.

The NPS is calculated by subtracting the percentage of Detractors from the percentage of Promoters. The resulting score ranges from -100 to +100. A higher score means a stronger customer base and better potential for growth.

Features of the NPS Survey

- Simple, one-question format

- Optional follow-up questions

- Standard scoring from -100 to +100

- Easy to use across different platforms (email, website, in-app)

- Actionable customer segmentation

Pros of Using NPS

- Quick for customers, leading to more responses

- Easy to understand and analyze

- Tracks trends over time to show the impact of business choices

- Correlates with business growth, valuable for planning

- Industry benchmarks available for comparison

Cons of Using NPS

- Simplifies complex customer relationships

- Doesn't give detailed reasons without follow-up questions

- Cultural differences can impact scores

- May not capture the full customer experience

- Needs follow-up questions for actionable insights

Examples of NPS in Action

Many large companies use NPS. Apple uses NPS to monitor customer loyalty. Airbnb uses it to measure satisfaction. American Express uses NPS to track cardholder relationships. Intuit uses it to measure user satisfaction with their financial software.

Tips for Implementing NPS

- Include a follow-up question: Ask an open-ended question like, "What is the primary reason for your score?" to get valuable qualitative data.

- Survey at key points: Survey after a purchase, after customer support interactions, or at regular intervals.

- Segment your results: Divide NPS results by customer demographics or product lines to find areas for improvement.

- Follow up with detractors: Addressing their concerns can improve negative experiences.

- Benchmark and track: Compare your score to industry standards and track changes over time.

Origins of NPS

The NPS was created in 2003 by Fred Reichheld of Bain & Company, in partnership with Satmetrix, and popularized through a Harvard Business Review article. Its simplicity and link to business growth make it a valuable tool.

The NPS survey is valuable because it's a quick, efficient, and well-understood metric. While not a complete solution by itself, when combined with follow-up questions and analysis, it gives useful insights that can drive business growth and improve customer relationships.

2. Customer Satisfaction Score (CSAT) Survey

The Customer Satisfaction Score (CSAT) survey is a key element of customer experience management. It measures short-term customer satisfaction with a specific interaction, product, or service. Its simplicity makes it a popular choice for businesses looking to gather immediate feedback and identify areas for improvement.

How It Works

The CSAT survey usually asks a simple question: "How satisfied were you with your experience?" Respondents choose from a 5-point Likert scale, from "Very Unsatisfied" to "Very Satisfied." The CSAT score is the percentage of "Satisfied" or "Very Satisfied" responses. This percentage provides a clear metric representing transaction-based satisfaction.

Key Features

- Focus on Specific Interactions: Pinpoints strengths and weaknesses within specific areas of the customer journey.

- 5-Point Likert Scale: Offers a standardized response format.

- Percentage-Based Results (0-100%): Allows easy tracking and comparison of satisfaction levels.

- Multi-Aspect Targeting: Can assess various aspects of a broader customer experience.

- Flexible Implementation: Deployable via email, website pop-ups, SMS, in-app messages, and more.

Pros

- Simple Implementation: Easy to deploy, even for small businesses.

- Immediate Feedback: Enables rapid identification of issues and opportunities.

- Easy Tracking: Allows businesses to monitor the impact of changes on customer satisfaction.

- Versatile Use: Applicable across various business functions.

- High Response Rates: The short format encourages participation.

Cons

- Response Bias: Satisfied customers are more likely to respond.

- Limited Scope: Focuses on individual transactions, not the long-term relationship.

- Cultural Differences: Interpretations of the scale can vary.

- Limited Predictive Value: Doesn't reliably indicate future behavior.

- Varying Interpretations: "Satisfied" can mean different things to different people.

Real-World Examples

- Amazon: Uses CSAT surveys after purchases and customer service interactions.

- Zappos: Leverages CSAT surveys to maintain high customer service standards.

- Uber: Uses CSAT to gather feedback on driver performance and ride quality.

- Best Buy: Implements CSAT at checkout and after support interactions.

Tips for Implementation

- Keep it Brief: Send surveys shortly after the interaction for maximum response rates.

- Include Open-Ended Questions: Gather qualitative feedback for richer insights.

- Target Specific Aspects: Focus on specific touchpoints for actionable insights.

- Track Progress: Set internal benchmarks and monitor improvements.

- Combine With Other Metrics: Use CSAT alongside metrics like Net Promoter Score (NPS) and Customer Effort Score (CES).

Popularized By

Organizations like the American Customer Satisfaction Index (ACSI), Service Management Group (SMG), and ForeSee Results (now part of Verint) have popularized CSAT surveys.

Why CSAT Matters

The CSAT survey is a fundamental tool for understanding and improving customer experience. Its simplicity and actionable insights make it invaluable for gathering feedback and identifying areas for improvement. While not the sole measure of customer experience, its ease of use makes it a powerful starting point.

3. Customer Effort Score (CES) Survey

The Customer Effort Score (CES) survey focuses on how much effort a customer exerts when interacting with your business. This could involve resolving an issue, making a purchase, or simply asking a question. CES aims to quantify the ease of these experiences. Instead of aiming for customer delight, CES works on the principle that reducing friction and making interactions effortless builds loyalty and retention. This makes it a valuable metric for businesses of all sizes.

CES surveys typically ask one question: "How easy was it to interact with [company/product/service]?" Customers answer on a 5 or 7-point scale, ranging from "Very Difficult" to "Very Easy." The resulting score, calculated as an average or percentage of "easy" responses, pinpoints where the customer journey is smooth and where there are hurdles.

Why CES Matters

Research indicates that reducing customer effort better predicts loyalty than exceeding expectations. A customer who easily navigates your website, quickly resolves a billing problem, or easily returns a product is more likely to return and recommend your business. This holds true even if a customer who experienced friction had a positive outcome in the end. CES is therefore a potent tool for improving customer retention and reducing churn.

Features and Benefits

- Focus on Ease: CES directly targets friction points in the customer journey.

- Simple Scale: The 5 or 7-point scale allows for easy customer responses and provides quantifiable data.

- Post-Interaction Measurement: CES is typically used after a specific interaction for targeted feedback.

- Actionable Insights: The results directly inform process improvement initiatives.

- Predictive Power: CES demonstrates a strong correlation with customer loyalty and retention.

Pros

- Strong predictor of customer loyalty and retention

- Directly tied to operational improvements

- Identifies friction points in the customer journey

- Provides clear direction for process improvements

- Less susceptible to cultural biases than satisfaction measures

Cons

- Doesn't measure emotional connection or delight

- Limited scope (focuses only on effort, not outcomes)

- May miss opportunities for positive differentiation

- Newer metric with fewer industry benchmarks

- Can be difficult to implement across all touchpoints

Real-World Examples

Many companies successfully use CES to improve customer experience:

- Cisco: Uses CES to optimize its technical support processes.

- Verizon: Implements CES to streamline customer service interactions.

- TD Bank: Tracks CES to identify friction points in banking transactions.

- Microsoft: Applies CES to product installations and setup experiences.

Evolution and Popularization

CES gained traction with the Harvard Business Review article "Stop Trying to Delight Your Customers" by Matthew Dixon, Karen Freeman, and Nicholas Toman of CEB (now Gartner). Their book, The Effortless Experience, further established CES as a key metric for customer service and experience management.

Tips for Implementation

- Map the Customer Journey: Identify key touchpoints for measuring effort.

- Follow Up: Conduct qualitative research with customers reporting high effort to understand the reasons.

- Prioritize Improvements: Use CES results to prioritize process improvements with the biggest impact on reducing effort.

- Validate Findings: Combine CES data with operational metrics to validate findings and track progress.

- Set Targets: Establish department-specific targets based on interaction type.

By focusing on reducing friction and making interactions effortless, businesses can build stronger customer relationships, improve loyalty, and drive growth. The Customer Effort Score provides a practical and effective way to measure and improve this critical aspect of customer experience.

4. Post-Purchase Feedback Surveys

A post-purchase feedback survey is a powerful tool for understanding the customer journey. It helps identify areas for improvement by collecting immediate impressions after a purchase. This provides a comprehensive view of the buying experience, from product discovery and website navigation to the checkout process. By capturing this feedback while it's still fresh, businesses gain valuable insights into what’s working well and what needs attention.

These surveys typically use multiple questions covering various aspects of the purchase. They often employ rating scales (e.g., star ratings, Net Promoter Score (NPS)) and open-ended questions for both quantitative and qualitative data. Product-specific questions can gauge customer satisfaction with the purchased item. Features like branching logic, where follow-up questions adapt based on previous answers, personalize and streamline the survey experience.

Why Are Post-Purchase Feedback Surveys Crucial?

Post-purchase feedback directly addresses the core elements influencing purchase decisions and repeat business. Understanding factors like website usability, product selection, pricing transparency, and the checkout process helps businesses identify friction points and optimize the customer journey. This results in higher conversion rates, reduced cart abandonment, and increased customer loyalty.

Real-World Examples

- Wayfair: Asks customers about their product discovery path and key purchase influencers to refine marketing and product placement.

- Sephora: Focuses on checkout experience feedback and purchase confidence to streamline payments and reduce anxiety.

- REI: Collects data on why customers chose them over competitors, providing insights into competitive advantages.

- B&H Photo: Includes questions about website navigation and product information adequacy to improve the user experience.

Pros

- Fresh Insights: Captures immediate feedback.

- Detailed Information: Provides specific insights into the purchase journey.

- Identifies Obstacles: Pinpoints conversion obstacles and cart abandonment causes.

- Informs Improvements: Guides website/app design and optimizes user experience.

- Boosts Repeat Purchases: Increases customer engagement and encourages repeat business.

Cons

- Survey Fatigue: Long surveys can lower completion rates.

- Timing Sensitivity: Sending surveys too early or late impacts feedback quality.

- Interruption of Flow: Poorly implemented surveys can create negative experiences.

- Selection Bias: Primarily captures perspectives of those who completed purchases.

- Requires Updates: Needs regular updates to stay relevant to evolving customer needs.

Tips for Implementation

- Keep it Concise: Aim for surveys under 5 minutes.

- Focus on Actionable Insights: Ask questions about improvable areas.

- Competitive Analysis: Include questions about competitor choices.

- Incentivize Participation: Offer small incentives like discounts.

- Optimize Timing: Test different intervals to determine the optimal post-purchase response period.

Evolution and Popularization

Post-purchase surveys were popularized by e-commerce pioneers like Amazon and refined by experts like ConversionXL. Platforms like Magento and Shopify now offer integrated survey tools, simplifying implementation. Consider this resource: Our guide on Getting Online Reviews with Email to further enhance your feedback strategy.

By incorporating these tips and best practices, businesses can leverage post-purchase surveys to gain a competitive edge, enhance customer loyalty, and drive sustainable growth.

5. Product Feedback Surveys

Product Feedback Surveys are essential for understanding how customers interact with your products or services. They go deeper than basic satisfaction surveys, providing specific insights into every part of the product experience, from first use to ongoing engagement. This makes them invaluable for product development, refinement, and, ultimately, keeping your customers happy. These surveys deserve a spot on this list because they provide actionable data that directly leads to product improvements and business growth.

What Are They?

Product Feedback Surveys assess product quality, features, usability, perceived value, and areas for improvement. They gather both quantitative data (like star ratings and multiple-choice answers) and qualitative feedback (like open-ended responses and text fields). This combination helps you understand not only what customers think, but why, creating a complete picture of the customer experience.

Key Features:

- Comprehensive Product-Focused Questions: These questions dive deep into specific features and functions, checking how well they work and how easy they are to use.

- Feature-Specific Satisfaction Ratings: Customers rate individual features, highlighting strengths and weaknesses within the product.

- Prioritization Questions for Future Development: These questions help measure customer interest in new features or improvements, informing the product roadmap.

- Competitive Comparison Elements (Optional): Some surveys compare your product to competitors, showing competitive advantages and disadvantages.

- Structured Ratings and Open-Ended Feedback: This balanced approach provides quantifiable data and rich qualitative insights.

- Visual Elements (Often Included): Visuals like product images can clarify questions and improve the respondent experience.

Pros:

- Actionable Insights: The data gathered can be directly used to improve products, making them more user-friendly and effective.

- Roadmap Prioritization: Understanding customer preferences helps focus resources on the most important features and updates.

- Unarticulated Needs Identification: Open-ended feedback can reveal hidden needs and frustrations that customers might not otherwise express.

- Risk Reduction: Early feedback can prevent costly mistakes and ensures your product aligns with customer needs.

- Customer Engagement: Asking for feedback shows customers you value their opinions, building loyalty and advocacy.

- Advocate Identification: Positive feedback can be used for marketing, showcasing happy customers and building social proof.

Cons:

- Length: Detailed surveys can be time-consuming, potentially lowering completion rates.

- Product Knowledge Required: Technical products might need a certain level of user understanding for meaningful feedback.

- Focus on Current Features: Feedback can be biased towards existing functions, limiting the exploration of new ideas.

- Technical User Bias: Feedback from tech-savvy users might not represent the average customer.

- Preferences vs. Needs: It's important to separate what customers want from what they need.

Real-World Examples:

- Adobe regularly surveys Creative Cloud users.

- Fitbit collects feedback on device and app features.

- Dyson uses surveys focusing on performance, design, and value.

- Nintendo uses surveys to understand gameplay and feature usage.

Tips for Implementation:

- Segment Feedback: Grouping responses by user type reveals specific needs.

- Focus on Used Features: Concentrate on usage patterns for more relevant data.

- Ask About Desired Outcomes: Understanding the "why" behind requests leads to better solutions.

- Use "Jobs To Be Done": This framework helps understand product purpose for customers.

- Follow Up: Interviews with select respondents can provide valuable context.

- Track Results Over Time: Measure the impact of product updates and improvements.

Popularized By:

Product-led companies like Apple and Google, SaaS pioneers like Salesforce and HubSpot, the Lean Startup methodology by Eric Ries, and user experience leaders like Nielsen Norman Group have all contributed to the use of Product Feedback Surveys. These organizations understand the vital role of customer feedback in driving product innovation and growth.

6. Customer Experience (CX) Survey

A Customer Experience (CX) Survey offers a powerful way to assess the entire customer journey. Unlike surveys focusing on single touchpoints, CX surveys examine every interaction a customer has with your company. This includes initial awareness, acquisition, onboarding, product use, customer support, and even renewals or repeat purchases. This broad view helps organizations find areas for improvement and build a customer-centric culture.

Features of a CX Survey

- Journey-based structure: The survey follows the customer lifecycle.

- Multi-dimensional measurement: It assesses various aspects of the experience across different touchpoints.

- Combination of metrics: Uses satisfaction, effort, and emotional metrics for a complete picture.

- Cross-channel experience assessment: Evaluates interactions across all channels (e.g., online, in-store, phone).

- Relationship and transactional elements: Considers the ongoing relationship and individual transactions.

- Customer journey mapping components: Often includes visual journey maps.

Pros of CX Surveys

- Holistic view: Provides a complete view of the customer relationship.

- Systemic issue identification: Identifies issues affecting multiple departments.

- Connects metrics to outcomes: Links experience metrics to business results.

- Prioritization: Helps prioritize improvements with the biggest impact.

- Understanding customer perceptions: Builds a comprehensive understanding of customer views.

- Reveals disconnects: Highlights inconsistencies between channels or departments.

Cons of CX Surveys

- Complexity: Can be difficult to design and analyze effectively.

- Time investment: Requires significant time from respondents.

- Implementation challenges: Needs cross-functional team commitment.

- Data overload: May generate a large amount of data.

- Maintaining consistency: Difficult to maintain consistent measurement.

- Sophisticated analysis: Requires advanced data analysis skills.

Real-World Examples

- USAA: Measures the entire financial services relationship.

- Disney: Tracks cross-channel experiences from booking to post-visit.

- Marriott Bonvoy: Monitors guest experiences across digital and physical touchpoints.

- T-Mobile: The "Voice of the Customer" program spans all channels.

Tips for Implementation

- Map the customer journey: Visualize the customer journey to identify key touchpoints.

- Use skip logic: Personalize questions based on customer experiences.

- Include rational and emotional components: Measure satisfaction and emotional responses.

- Balance comprehensiveness with length: Keep the survey concise.

- Link CX metrics to business outcomes: Connect improvements to key performance indicators (KPIs).

- Establish cross-functional teams: Involve all relevant departments.

- Consistent measurement: Use a regular cadence and consistent methodology.

Evolution and Popularization

The rise of CX surveys reflects the growing recognition of customer experience's importance in business success. Forrester Research's Customer Experience Index (CX Index) has played a key role, along with platforms like Qualtrics and Medallia. The work of Bruce Temkin and the XM Institute has also been influential.

You might be interested in: Mastering Customer Reviews to use positive feedback for business growth.

This comprehensive approach makes the CX survey a vital tool for understanding and improving customer relationships. It offers valuable insights that can drive significant improvements across the entire customer journey, leading to increased customer loyalty and business growth.

7. Voice of Customer (VoC) Program

A Voice of Customer (VoC) Program is the most thorough way to collect and use customer feedback. It goes beyond simple surveys to build a complete picture of the customer experience. Instead of isolated snapshots, a VoC program creates a constant flow of insights from many channels and touchpoints. This lets businesses truly grasp customer needs, expectations, and perceptions throughout their entire journey.

VoC programs bring together various feedback sources. These include traditional customer satisfaction surveys, online reviews, social media monitoring, and customer support interactions (email, chat, phone). Some programs even incorporate operational data.

Features and Benefits of a VoC Program

Features like text analytics and sentiment analysis help interpret this feedback, providing actionable insights. Real-time alerts for negative feedback enable proactive service recovery. Integration with CRM and operational systems ensures that insights are accessible to those who can use them. Executive dashboards and reporting tools help visualize trends and track progress, facilitating a data-driven approach to improving the customer experience.

- Multi-channel feedback collection: Surveys, social media, support interactions, etc.

- Closed-loop feedback management: Ensures feedback is addressed and resolved.

- Text analytics and sentiment analysis: Provides deeper understanding of customer feedback.

- Real-time alerting: Enables prompt reaction to negative feedback.

- CRM and operational system integration: Makes insights readily available.

- Executive dashboards and reporting: Visualizes key trends and progress.

- Systematic process: Drives organizational change focused on the customer.

Advantages and Disadvantages of VoC Programs

Pros:

- Comprehensive View: Goes beyond single surveys for a deeper understanding.

- Broad Feedback Capture: Collects both solicited and unsolicited feedback.

- Accountability: Creates organizational responsibility for the customer experience.

- Trend Identification: Spots issues across all touchpoints.

- Proactive Service Recovery: Addresses negative feedback quickly.

- Business Outcomes: Links feedback directly to business results.

- Customer-Centricity: Fosters a sustainable customer-focused culture.

Cons:

- Investment: Requires significant resources and technology.

- Implementation: Can be complex across different departments.

- Commitment: Needs executive sponsorship and cultural buy-in.

- Data Overload: Potential for overwhelming data without proper management.

- Dedicated Staff: Requires personnel to manage the program effectively.

- ROI Measurement: Direct return on investment can be challenging to quantify.

Examples and Implementation Tips

Examples of Successful VoC Programs:

- JetBlue: Integrates survey, social media, and operational data for a 360-degree view.

- Microsoft: Uses its Customer & Partner Experience (CPE) system across all product lines.

- Salesforce: Employs an integrated platform spanning all touchpoints.

- Comcast: Improved its customer service through a comprehensive VoC initiative.

Tips for Implementing a VoC Program:

- Clear Objectives: Start with goals tied to business outcomes.

- Governance Structure: Establish cross-functional representation.

- Closed-Loop Process: Respond to individual feedback.

- Clear Ownership: Assign responsibility for driving improvements.

- Balance Strategies: Combine strategic insights with quick wins.

- Regular Communication: Share findings and actions with customers.

- Performance Integration: Include VoC metrics in performance evaluations. For further information, see our guide on mastering online reviews and testimonials.

Evolution and Importance of VoC Programs

The growth of experience management platforms like Medallia, Qualtrics, and InMoment has simplified the implementation of sophisticated VoC programs. Consultancies like Walker and Forrester have contributed to VoC adoption. The CCXP (Customer Experience Professionals Association) certification and thought leaders like Jeanne Bliss and Harley Manning further emphasize the importance of VoC.

A VoC program deserves its place on this list because it represents the most developed and impactful approach to customer feedback. While other methods offer valuable insights, a VoC program connects those insights to action, creating continuous improvement. It's a long-term investment that can reshape a business by prioritizing the customer in every decision.

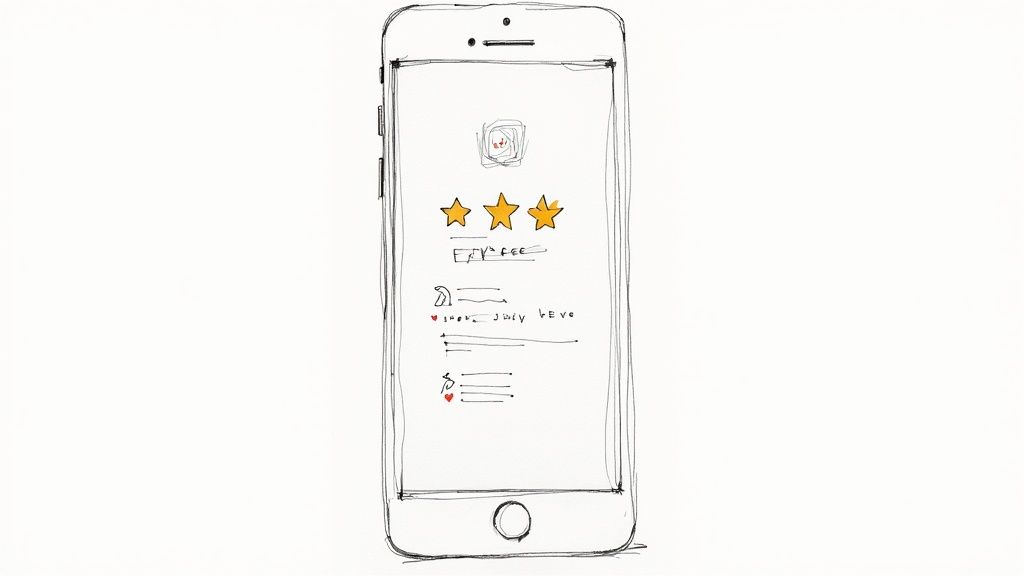

8. Mobile App Feedback Surveys

Mobile app feedback surveys are crucial for understanding user sentiment and improving app performance. They provide a direct connection to your users, offering valuable insights into their experiences within the mobile environment. These surveys are tailored to the limitations of mobile interfaces, utilizing short, targeted questions delivered at optimal moments in the user journey. This allows developers to efficiently prioritize improvements, identify bugs, and analyze feature adoption.

Why Mobile App Feedback Surveys Are Essential

A positive app experience is essential for business success. Mobile app feedback surveys offer a highly effective method for capturing user sentiment directly within the app. This leads to higher response rates and more relevant feedback compared to traditional methods like email. This direct feedback loop promotes continuous improvement and helps businesses retain users by proactively addressing their concerns.

Key Features

- In-app Triggering: Surveys appear at specific points in the user journey, like after completing a task or making a purchase.

- Micro-Surveys: Short, focused questions (1-3) minimize disruption to the user experience.

- Event-Triggered Feedback: Surveys can be triggered by specific events, such as encountering an error.

- Visual Rating Systems: Star ratings and emoticons provide quick and easy feedback options.

- Screenshot Annotation: Users can visually identify problems by annotating screenshots.

- Analytics Integration: Combining survey data with app usage provides a deeper understanding of user behavior.

- Device-Specific Feedback: Pinpoint technical issues specific to particular devices or operating systems.

Pros

- Contextual Insights: Captures feedback related to specific user actions.

- Improved Response Rates: More convenient than external surveys.

- Reduced User Churn: Proactively identifies and resolves issues.

- Focused Feature Development: Understand which features users value most.

- Device Optimization: Ensures optimal performance across different devices.

Cons

- Limited Complexity: Screen size restricts question types and quantity.

- Potential Disruption: Poorly timed surveys can frustrate users.

- Active User Bias: Provides limited insight into why users leave.

- Performance Impact: Poorly implemented surveys can affect app speed.

- Limited Qualitative Data: Difficult to gather detailed, open-ended feedback.

Real-World Examples

- Duolingo: Solicits feedback after lessons.

- Instagram: Gathers feedback on new features.

- Uber: Collects feedback on trip experiences.

- Headspace: Uses ratings to assess user satisfaction.

- Weather Channel: Requests feedback on location accuracy.

Tips for Implementation

- Strategic Timing: Trigger surveys after key actions, avoiding critical tasks.

- Concise Questions: Aim for under 25 characters per question.

- Visual Scales: Encourage quick responses with visual rating scales.

- Trigger Testing: Optimize trigger points for response rates and minimal disruption.

- Combined Feedback: Use in-app feedback buttons alongside triggered surveys.

- Smart Sampling: Target specific user segments to avoid survey fatigue.

- Bug Reporting: Allow users to easily report bugs with screenshots.

Evolution and Popularization

Mobile app feedback surveys grew alongside mobile app analytics platforms like Apptentive and Instabug. Tools like Mixpanel and Amplitude enhanced feedback collection by integrating it with product analytics. Platforms like UserVoice and Usersnap also contributed to refining and popularizing this important practice. This evolution has simplified feedback gathering and mobile app improvement for businesses of all sizes.

8-Point Customer Survey Comparison

Turning Insights Into Action: Elevate Your Customer Experience

Understanding customer satisfaction is crucial for any business. From the straightforward Net Promoter Score (NPS) to the more detailed insights of a Voice of Customer (VoC) program, various survey methods empower businesses to improve their customer experience. Key principles include keeping surveys concise, asking clear questions, and ensuring the process is easy for customers.

Choosing the right survey type is essential for gathering effective feedback. A post-purchase survey might be ideal for e-commerce businesses, while a brick-and-mortar store could benefit from a CSAT survey focused on in-store interactions. Mobile app developers can use in-app surveys for instant feedback, while B2B companies might opt for a more formal CX survey. Analyzing the results and acting on the feedback is paramount, regardless of the survey type.

Adapting Your Strategy

Learning and adaptation are essential for sustained success. Regularly review and refine your survey approach. Experiment with different question types and survey lengths to optimize response rates and the quality of the feedback you receive. Staying current with customer experience trends allows you to adapt and improve your strategies. The future of customer feedback involves personalized, real-time interactions, integrating AI and machine learning to analyze sentiment and anticipate customer behavior.

Key Takeaways For Effective Surveys

- Choose the Right Survey Type: Align your survey choice with your business objectives and where you interact with your customers.

- Keep It Concise and Clear: Specific questions and avoiding jargon will result in better response rates and more useful feedback.

- Act on the Insights: Don't just collect data—use it to improve your products, services, and the overall customer experience.

- Continuously Adapt: Regularly review and adjust your methods to stay ahead of changing customer expectations and industry best practices.

kisReviews simplifies collecting and showcasing customer reviews. With automated tools for gathering reviews on Google and Yelp, user-friendly QR codes, and customizable website widgets, kisReviews helps businesses build a strong online reputation, enhance customer engagement, and drive growth. Start strengthening your brand with social proof today! Explore flexible pricing plans and discover how kisReviews can benefit your business. Get started with kisReviews now!